Kolleno on Forbes

17 Feb 2023

Late payments are endemic: in the UK alone, more than half of small and medium-sized enterprises say customers setting their bills late is having a critical impact on their businesses - and more than 400,000 fear collapsing as a result. Yet coming up with solutions to the problem is difficult – other than the hard grind of manually chasing every bad debt.

London-based fintech Kolleno thinks it can help. The start-up, which is today announcing the completion of a £4m seed funding round, has built a credit control and collections platform that automates much of the work of the accounts receivables department. That includes chasing customers to pay their bills in a more timely fashion.

“The collections industry is behind the curve on its adoption of technology, so we saw an opportunity to create a 21st century collections platform,” explains Dimitri Raziev, CEO and co-founder of the business. “Our aim is to help credit controllers work more effectively and efficiently, and to give CFOs a better understanding of their cashflow and working capital.”

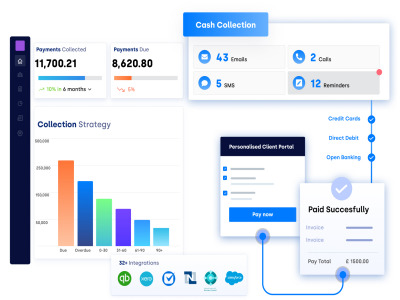

Once businesses give Kolleno access to their accounts receivables book, the platform automates the management of invoices due. Customers behind schedule on payments receive emails and text messages reminding them to settle their bills, with each communication providing access to a payments portal so they can pay what is owed immediately.

Kolleno’s platform also uses machine learning tools to work out the most effective way to chase customers. Some may respond better to emails than text messages, for example. In other cases, the platform may suggest the credit control team calls the customer instead.

The machine learning tools also make a calculation about tone of voice – loyal customers with a good history of paying on time will get a gentle nudge if they overlook one payment. Serial late payers can expect a tougher approach. And where a customer is particularly crucial to the business – accounting for a significant chunk of its revenues, say – the system will alert credit controllers so they can intervene.

“Previously, businesses had to hire credit control specialists or give extra tasks to existing members of their team to manually monitor the payment dynamics of customers,” says Raziev.

“An employee had to identify late payers, then prioritise, contact and follow up with individual clients to ensure late payments were received. This was not only time-consuming but also stressful for business owners and often prone to errors.”

Launched in 2020, Kolleno has grown quickly, and now has customers in the UK, US, Canada, South Africa and Europe. So far, it has processed more than 170,000 invoices sent to customers in more than 20 countries.

Raziev says the data speaks for itself. Customer engagement with the emails and text messages that the portal sends is 85% higher than clients experienced before using Kolleno. Collection rates are running at above 90% - well ahead of what businesses might usually expect.

Those gains come with the added bonus of efficiency, Raziev argues. “We think our system will save the typical credit controller around 35% of their working week,” he says. “That’s time they can give to more value-additive tasks.”

CFOs also report benefits from the system, which provides a constant read out of the business’s cashflow. That enables better planning and financial management.

Raziev thinks Kolleno’s sweet spot is the mid-sized market. Smaller businesses may not feel overwhelmed by their accounts receivable workloads while enterprise customers have access to other tools. But for medium-sized businesses – those with annual revenues of up to £5m, say, issuing more than 20 invoices a month – the system solves a real problem.

That’s not to say Kolleno does not have clients outside of this category. They include a number of law firms, which tend to be smaller businesses that lack specialist credit staff (and for whom using lawyers’ time to chase bad debts is an expensive use of resources). Several larger enterprises are also using the platform.

Customers pay a monthly fee for Kolleno – most mid-sized clients are charged a fixed price, with smaller and larger firms paying more bespoke fees depending on how the use the platform.

It is a model that has attracted significant interest from investors. Today’s seed round is led by Eurazeo and Stride Venture Capital, with participation from Euler Hermes, HubSpot and several angel investors including Michael Pennington, Mark Ransford, and Will Neale.

The additional funding will support product development as well as a further internationalisation of sales and marketing, Raziev adds. “We want to help businesses survive and thrive.”

See Kolleno at Facilities Show 2023

Meet Kolleno at stand FM.3060 on the 16-18 May 2023 at the ExCeL London when the co-located IFSEC, FIREX, Facilities Show and Safety & Health Expo events take place!

Product

Kolleno

-Accounts Receivable Management: Spend less time managing your receivables. Enrol your clients and replace outdated manual processes with automated digital collection strategies and communications.

-Payments & Reconciliation: Provide your clients with multiple digital payment optio...

![[Facilities] What To Do When Customers Are Not Paying On Time](/r0th_S-file134863.jpg)